What is the journal entry for the following. The Agricultural Experience Tracker AET is a personalized online FFA Record Book System for tracking experiences in High School Agricultural Education courses.

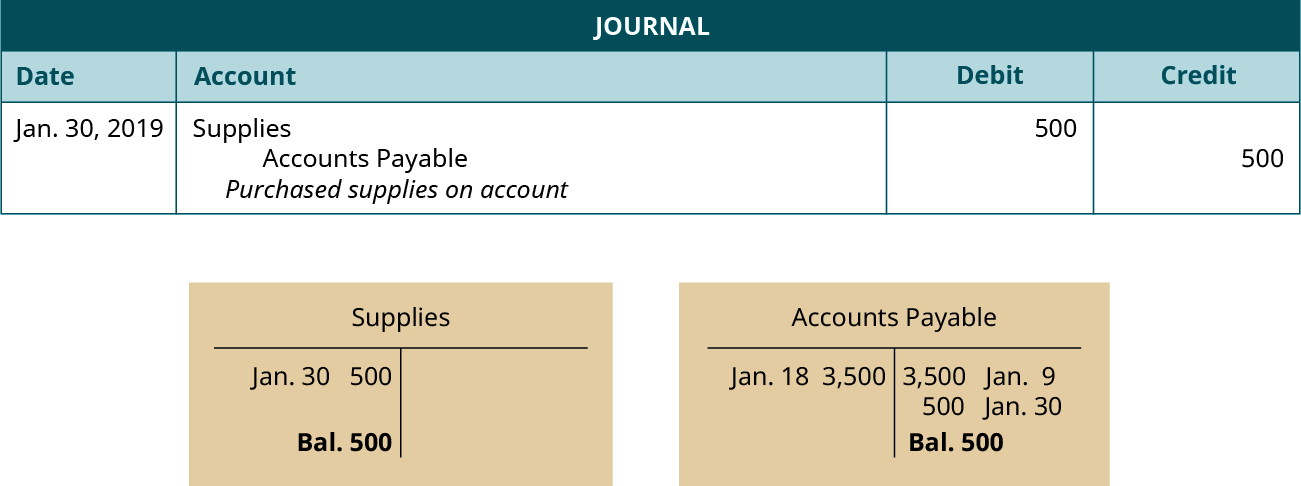

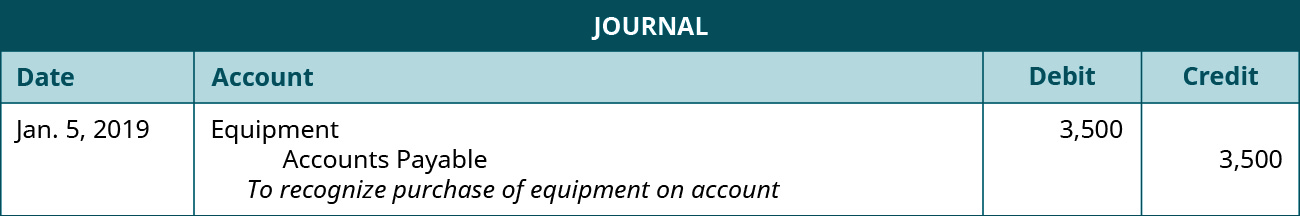

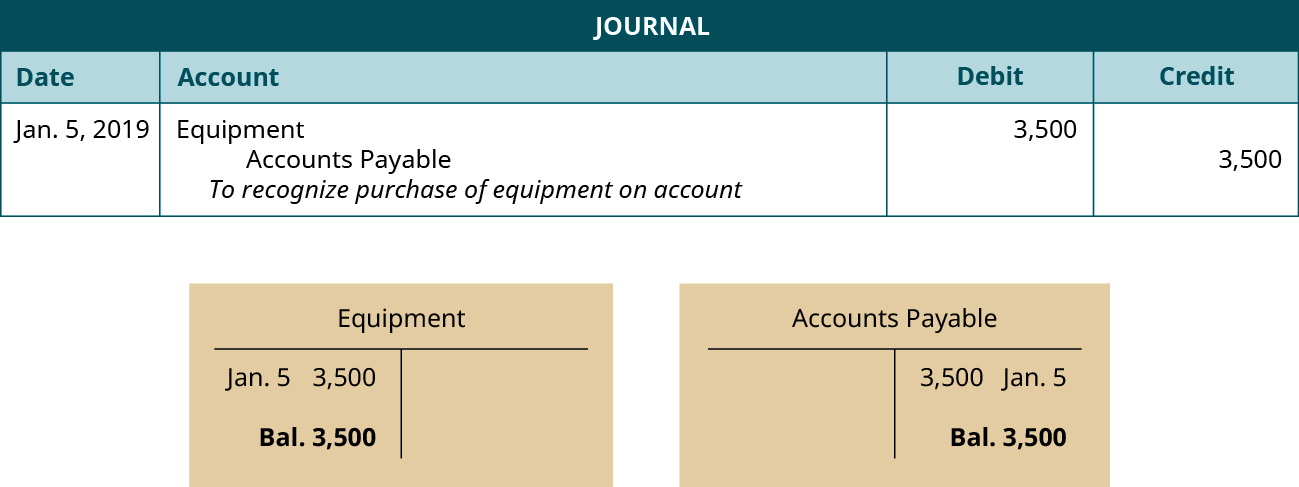

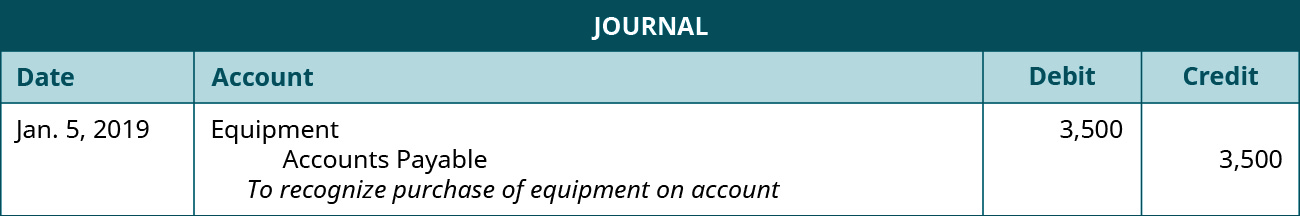

Use Journal Entries To Record Transactions And Post To T Accounts Principles Of Accounting Volume 1 Financial Accounting

Purchased goods from KJ Mehta for cash.

. The bookkeeping entry to reclassify the current portion of long term debt will be. Journal entries are the way we capture the activity of our business. Rupees Indian currency A.

The accumulated depreciation journal entry is recorded by debiting the depreciation expense account and crediting the accumulated depreciation account. On December 7 the company acquired service equipment for 16000. Debit the Inventory or other asset account for the value of the goods purchased and credit the Letter of Credit account for the payment issued by the bank.

The adjusting entry will reclassify the amount of principle due in the coming year to a current liability account. Specify the Transaction Entered. While this may seem like the easiest step it is also one that is commonly overlooked.

Accumulated Depreciation Journal Entry Example Construction Bobs Inc. This will result in a compound journal entry. This is because they are items of monetary value for the business - the business will sell them to.

You have to structure your business in a way that identifies each applicable transaction. There are three basic steps when making a journal entry and writing the actual entry itself comes last. Recently purchased a new car that cost 5000 for making deliveries and picking up new supplies.

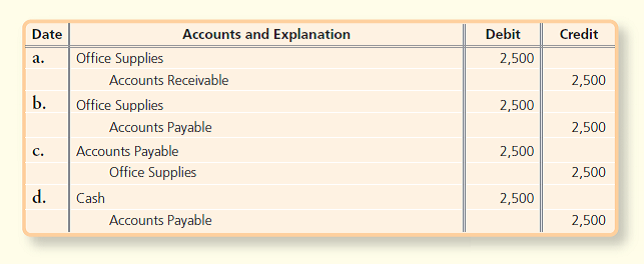

Double-entry bookkeeping in accounting is a system of bookkeeping so named because every entry to an account requires a corresponding and opposite entry to a different accountThis lesson will cover how to create journal entries from business transactions. Goods or stock or inventory all these words mean the same thing are classified as assets in accounting. The company paid a 50 down payment and the balance will be paid after 60 days.

You dont need to concern yourself with this entry or this account during the year. This journal entry eliminates the cash or credit reserved for the letter of credit and records an asset for the inventory or other resources received from the transaction. Journal Entry for Purchasing Goods.

Journal Entry For Purchased Computer Laptop And Paid By Cheque Journal Entry For Purchased Equipment On Account Or Credit Journal Entry For. How Do You Make a Journal Entry. There is an increase in an asset account debit Service Equipment 16000 a decrease in another asset credit Cash 8000 the amount paid and an increase.

Purchase Office Supplies On Account Double Entry Bookkeeping

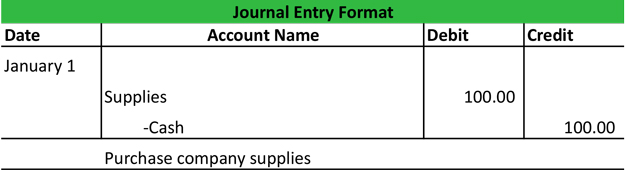

Business Events Transaction Journal Entry Format My Accounting Course

Answered Accounts And Explanation Debit Date Bartleby

Use Journal Entries To Record Transactions And Post To T Accounts Principles Of Accounting Volume 1 Financial Accounting

Recording Purchase Of Office Supplies On Account Journal Entry

Paid Cash For Supplies Double Entry Bookkeeping

Use Journal Entries To Record Transactions And Post To T Accounts Principles Of Accounting Volume 1 Financial Accounting

0 comments

Post a Comment